Keyfund Protocol Whitepaper

A common misconception with heavy APY averages is the subjectivity of the permanent loss of staking LP (liquidity provider) on farm reward generators. With the DeFi boom, we've seen too many new cryptocurrency miners get sucked into the trap of high LP APY farming, feeling hopeless that they were pushed out by previous buyers in exchange for higher stakes. We've all been there, seeing that shiny 6-digit number can be tempting to jump in.

However, almost always tokens experience an inevitable valuation bubble, which is then followed by an impending explosion and fall in price. This is why we have seen the mass adoption of static rewards, also known as reflection, a separate concept that seeks to eliminate the problems caused by agricultural rewards.

Automatic Liquidity Pool (LP)

Auto LP is KeyFund's secret sauce. Here we have a function that acts as a doubly useful implementation for the holder. First, the contract sucks the tokens out of the seller and the buyer, and adds them to the LP creating a solid price floor.

Second, the penalty acts as an arbitrage-resistance mechanism that secures the KeyFund volume as a reward to its holder. In theory, the added LP creates the stability of the provided LP by adding tax to the overall liquidity of the token, thereby increasing the overall LP of the token and supporting the underlying price of the token. This is different from other reflection token burn functions which only benefit in the short term from a given supply reduction.

As LP KeyFund tokens increase, price stability reflects this functionality by benefiting from a solid price base and cushioning for holders. The goal here is to prevent a bigger drop when the whales decide to sell their tokens later in the game, which keeps the price from fluctuating as much as if there wasn't an auto LP function.

Auto Burn

Sometimes burning material; sometimes not. Continuous burning on any of the protocols can be great in the early days, however, this means burning cannot be limited or controlled in any way. Having burns controlled by the team and promoted based on achievements helps keep the community rewarded and informed. Manual burning conditions and quantities can be advertised and tracked.

KeyFund aims to implement a burning strategy that is beneficial and beneficial to those involved in the long term. Furthermore, the total number of KeyFunds burned is displayed on our readout located on the website allowing further transparency in identifying the current circulating supply at any given point in time.

KeyFund Transaction Fee

KeyFund uses 3 simple functions: Reflection + LP acquisition + Burn In every trade + Dev Fee, transaction is subject to 5% fee.

- 1%

Go to the holder (directly at no cost) - 2%

Locked into liquidity forever (allows trading) - 1%

Spending outreach to make us grow* - 1%

Directly burned to a dead address

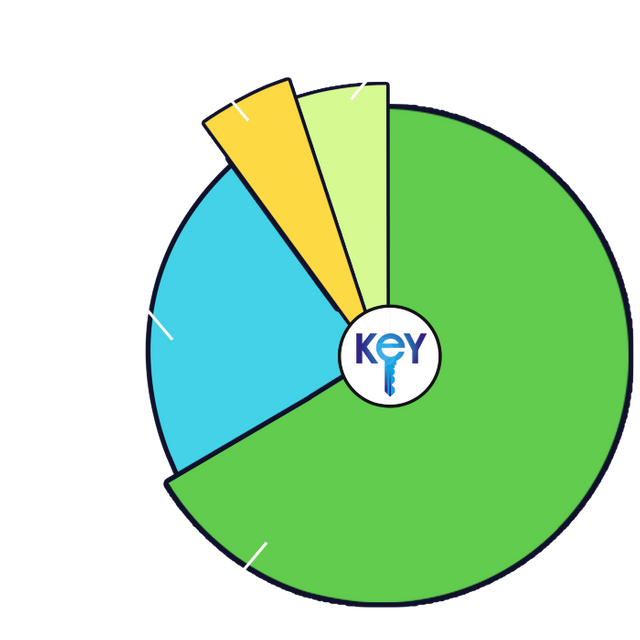

Token Distribution

TOKENOMIC

- 5% advisor

- Marketing: 5%

- Founder 20%

- 70% Sales

Deflation Token With Max Supply

- 1 KeyFund — $0.02

Circulating Supply - 110,000,000

Token Sale - 77,000,000

soft hat - 22,000,000

Start time - August 6

End of time - August 8

min. Investment - $10

For more detailed information:

Website : https://key.fund/

whitepaper : https://key.fund/whitepaper/

Join Telegram Official Group — https://t.me/Key_Fund

Join Telegram Bounty Group — https://t.me/joinchat /WQU3EHQe_FtkMmJh

Follow us on Medium: https://medium.com/@Key_Fund

Follow us on Reddit: https://www.reddit.com/r/KeyFund

Posting Komentar